China's Food Security Bet

A few weeks ago, the Chinese government officially implemented a new food security law. The legislation essentially regulates various aspects of the Chinese agricultural industry and creates official bodies and frameworks to enforce these regulations. While most of these measures have more or less already been implemented by the CCP (Chinese Communist Party) over the years, they were not systematic or at an optimal scale. What is worth noting here is the fact that the law was passed only after six months since its initial introduction. This highlights a crucial reality: Beijing is facing increasing pressure to make significant changes to its entire agriculture sector and achieve grain self-sufficiency, especially for corn and soybeans.

What are the domestic and international dynamics driving the Chinese government's aggressive push towards grain self-sufficiency? And how is the global grain market evolving?

China's Tough Spot

China is the world's largest producer of rice and wheat, the second largest for corn, and the fourth for soybeans. So, why does Beijing really need to import grains?

If we look at the data, one trend we can clearly see is that the consumption of meat, dairy, and processed foods is very significantly increasing in China - mostly due to rapid economic growth and to people moving from rural areas to large cities. These three categories of food originate from livestock, which means that more animal feed is required to meet the growing demand. In China, cattle are mostly fed corn and soybeans. Since humans also directly consume these two grains, corn and soybean producers are struggling to keep up with this rapidly increasing demand.

But, why are Chinese farmers really struggling to keep up?

A number of factors currently limit China's ability to produce the grains it needs domestically.

One, while China represents around 20% of the global population, it only has 9% of the world's arable (that can grow crops) land. This is due to the (very) rapid expansion of some of its cities, which has led local governments to replace farmlands with massive infrastructure. The Chinese government's push for industrialization also meant that a number of farms were converted into factory floors. Two, water scarcity is something that has been plaguing China's agricultural sector, especially in Northern areas, for years. The reason for these shortages is that some Chinese farmers are systematically over-extracting groundwater for irrigation, leaving others with limited access to water. The fact that China's rapid industrial growth polluted a very significant number of water sources did not make this situation any better. Three, soil degradation. Groundwater is not the only thing that Chinese farmers are overusing. Fertilizers are very heavily used in Chinese farms, a lot of times in such an excessive way that the fertility of lands starts decreasing, leading to lower and lower yields. Four, although China has invested massively in agricultural R&D, especially in reverse-engineering Western machines and techniques, it is still lagging behind countries like the US or Brazil. While this doesn't directly decrease China's grain production capacity, it does partially explain the structural weakness of the country's agricultural sector.

As mentioned earlier, the Chinese government has implemented different measures over the years to address the root causes preventing the country from truly reaching its agricultural potential. In addition to these directives - and the recent food security law - Chinese companies have received very significant financial incentives from the government to develop high-yield crop varieties, genetically modified crops, and advanced irrigation techniques. These initiatives have had mixed success, but have gradually improved the sector overall. That being said, Beijing achieving its strategic goals in terms of self-sufficiency will not happen overnight. To meet the country's domestic demand, both the Chinese government and private companies have relied on imports - mostly from the US and Brazil.

Grain Competition

The global grain market is largely dominated by the competition between the US and Brazil - especially in terms of soybeans and corn.

Historically, the US has been the leading producer and exporter of soybeans globally, thanks to its highly mechanized farming techniques and robust infrastructure. That being said, Brazil has gradually been closing the gap between the two countries and finally overtook the US as the number one exporter of soybeans in 2022. Brazil's jump to first position was mainly driven by Chinese importers choosing to work with non-US suppliers to meet their country's animal feed demand. In fact, over 60% of Brazil's soybean exports now go to China. When it comes to corn, the US is still the global leader - both in production and export. Again, the technological edge, especially genetically modified organisms, precision farming, and advanced machinery, is giving the US a significant leg up over most countries when it comes to growing crops. However, one crucial factor is providing the Brazilian corn sector with a very significant boost - potentially enough to surpass the US at some point in time.

The US has a temperate climate, which means that only one harvest season for most crops is possible. On the other hand, Brazil, which has a tropical climate, can have multiple harvests per year, for both corn and soybeans. US officials are obviously aware of this major difference and know that Brazilian producers are also trying to close the technological gap by purchasing European cutting-edge equipment - as well as hiring US experts to transfer critical technologies. As a result of that, research in Brazilian academic centers and corporations has reached unprecedented levels. To maintain their global leadership in corn export, the US has leaned heavily on free trade agreements like the US-Mexico-Canada Agreement, as well as trade disputes and arbitration in some cases, especially as some countries are adopting tougher stances on GMOs - which is hurting US companies. Deforestation has always been a thorny issue in Brazil, and Western countries - especially in Europe - have issued multiple regulations and directives over the last few years that limit the global trade of Brazilian corn and soybeans if producers do not adhere to specific environmental standards. Obviously, the US has directly and indirectly contributed to these restrictions in order to prevent Brazil from becoming the number one exporter of corn and further erode the global market share of American grain producers. However, US farmers face structural challenges that are also hurting their production. Other than the rising cost of fuel, seeds, fertilizers, and equipment, drought is making it increasingly harder for US producers to compete with their Brazilian peers.

What are Beijing's calculations regarding grain imports, especially soybeans and corn?

Risky Business

As mentioned earlier, China saw a very rapid expansion of its livestock industry driven by the rising demand for certain food categories. This growth started in the early 2000s and led the Chinese government to rely heavily on US soybean and corn producers to meet its animal feed demand.

Although Beijing was fully aware that China's reliance on the US for soybeans and corn presented a major strategic risk, the Chinese government didn't do much to diversify suppliers. Why was China complacent on that end? Back then, economic and trade relations between the two countries were rather stable. US producers had solid logistics and infrastructure, offered consistent quality, and, more importantly, were able to meet China's demand as it scaled up. In other words, the CCP saw no reason to significantly decrease the country's dependence on the US - even if it was gradually exploring broader sourcing opportunities in Brazil and Argentina.

Then, Trump was elected, and everything changed. A major priority for the Trump administration was to address the very significant trade deficit with China and what Washington viewed as unfair trade practices by the Chinese government, such as intellectual property theft and dumping. In order to level the playing field for US manufacturers and lessen the trade deficit, the US imposed tariffs on a number of Chinese goods back then. The move was largely unprecedented and did hurt Chinese exports. Beijing wanted to deter the Trump administration from implementing more tariffs, so the Chinese government decided to retaliate in a drastic way and implemented its own tariffs on agricultural commodities such as corn and soybeans. While the move significantly hurt the US agricultural sector, China had effectively shot itself in the leg. By placing these tariffs, the Chinese government had essentially disrupted its supply chain of grains, jacked up the costs of animal feed, and, therefore, significantly increased consumer prices, putting a number of small food producers and distributors out of business in the process. The trade war between the two countries, and the subsequent economic fallout in China, was a wake-up call for Beijing. It was time for the Chinese government to listen to the hundreds of experts who had been warning about the risks of overreliance on the US for agricultural commodities. China started engaging with different suppliers in Brazil, Argentina, and South Africa to gradually replace the existing US exporters.

Although Brazil has largely replaced the US as the main supplier of soybeans and corn to China, Beijing is still pushing for grain self-sufficiency - why is that?

Chinese Thinking

China has very good relations with the current Brazilian government, which means that a trade war between the two countries is highly unlikely. The same can be said about the possibility of the Brazilian government using China's grain dependence to extract concessions. So, what is really driving Beijing's grain self-sufficiency strategy?

A number of overlapping factors.

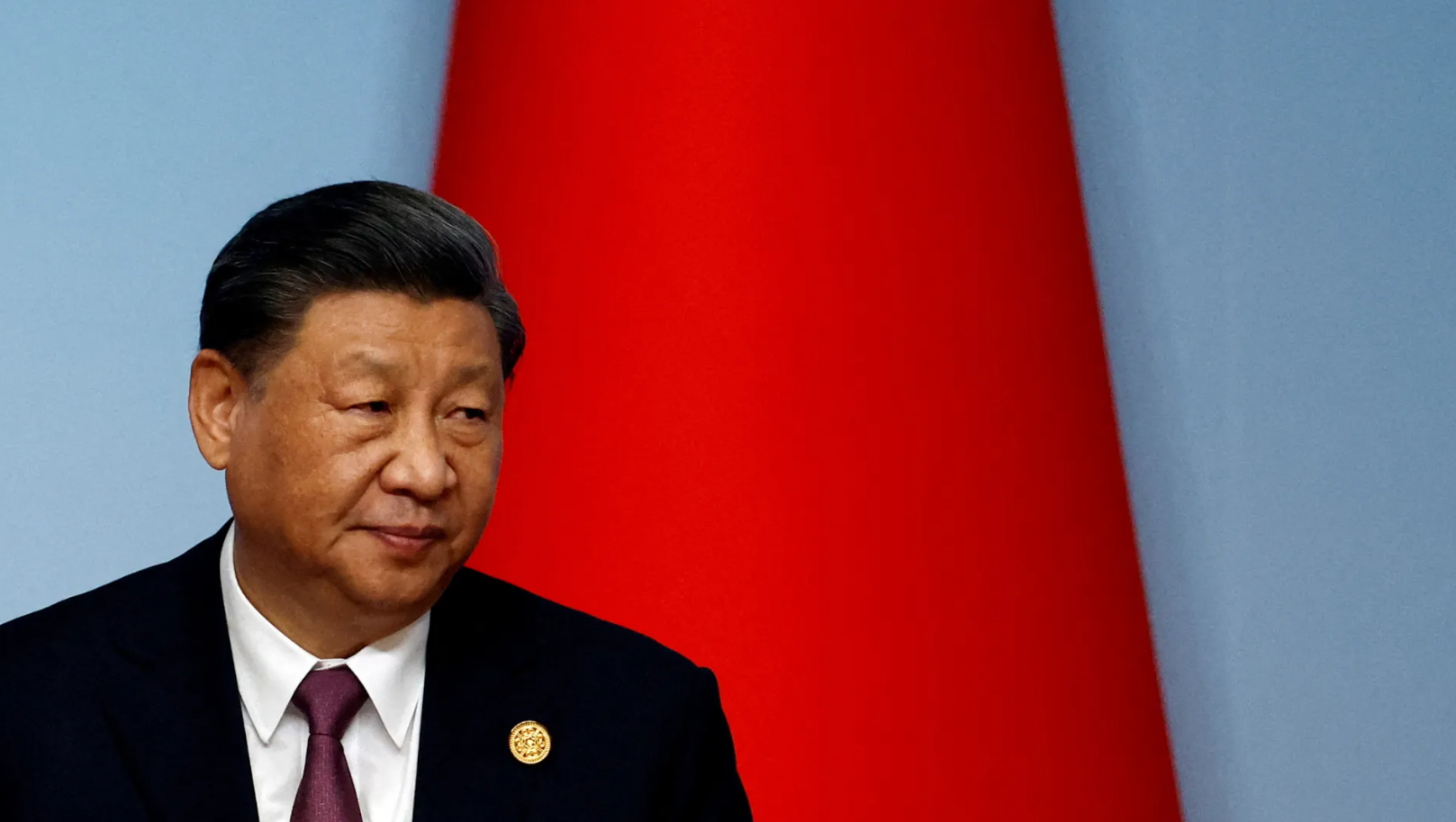

Western governments tend to underestimate the impact of historical events on the decision-making process of Chinese leaders. It is no secret that Chinese President Xi Jinping's thinking is heavily shaped by major historical periods that have redefined China. Two of these periods are the Qing Dynasty (17th to 20th century), and the Great Leap Forward (1958 to 1962) during which the founder of the People's Republic of China, Mao Zedong, aggressively pushed for the country to transition from being an agricultural society to an industrial one. While these two periods have very different lengths and dynamics, they do share a common theme: deadly famine. Under both reigns, famines ravaged Chinese society, mostly due to drought and resource mismanagement. During the Great Leap Forward, over 40 million Chinese died of hunger in less than three years. This was the worst famine in history, and it unsurprisingly led to social unrest and rioting. Xi sees some commonalities between these two historical periods of famine and China today, namely resource mismanagement and droughts. For that reason, the Chinese President is going the extra mile to ensure that history doesn't repeat itself.

The war in Ukraine is another event that highlighted the risks for China's leadership in relying on foreign grain suppliers. At the beginning of 2022, 27% of the corn that China was importing was coming from Ukraine. Although a number of Chinese officials had prior knowledge of the Russian invasion, the war forced Beijing to look for alternative suppliers of corn - primarily Brazil - almost overnight. This event further pushed Xi to redefine the country's food security agenda and stimulate domestic production to decrease imports and exposure to global supply chain disruptions.

One more subtle consideration that significantly contributed to Beijing's current agricultural policies is seed technology. While China can decrease the volumes of corn and soybeans it imports, Chinese farmers still need to import certain seeds, especially genetically modified ones used to plant high-yield crops. The vast majority of these seeds are developed by US or European companies. Given the R&D costs to develop genetically modified seeds, these companies have very robust patents protecting their innovations. Beijing's controversial approach to intellectual property has deterred a considerable number of companies from working with Chinese producers, which has made it difficult for farmers in China to grow high-yield crops. But, that doesn't mean that China doesn't have access to Western genetically-modified seeds. The problem for Beijing is that this access is becoming less certain every day, with Western countries rolling out frequent measures to restrict the transfer of critical technologies to China. The Chinese government's biggest concern is that an embargo will be put in place to prevent China from getting any of these seeds. This situation was simply untenable for the CCP and is one of the main driving forces behind China's new food security strategy, which includes R&D incentives.

Closing Thoughts

China's path to overall grain self-sufficiency will not be an easy one. On the other hand, China decreasing its reliance on soybeans and corn imports will significantly impact the world's major producers. Brazil, the US, and Argentina will have to adapt to a new global commodities landscape with possibly uncertain dynamics and considerable volatility. Each of these producing countries will face different challenges - but also opportunities to consolidate their positions in the global marketplace.

Did you enjoy this piece? Sign up today to access Geopolitics Insider's entire library of insights and receive two deep-dives a week straight to your email. You can cancel any time.